social security tax limit 2022

The OASDI tax rate for wages in 2022 is. For every 2 you exceed that limit 1 will be withheld in benefits.

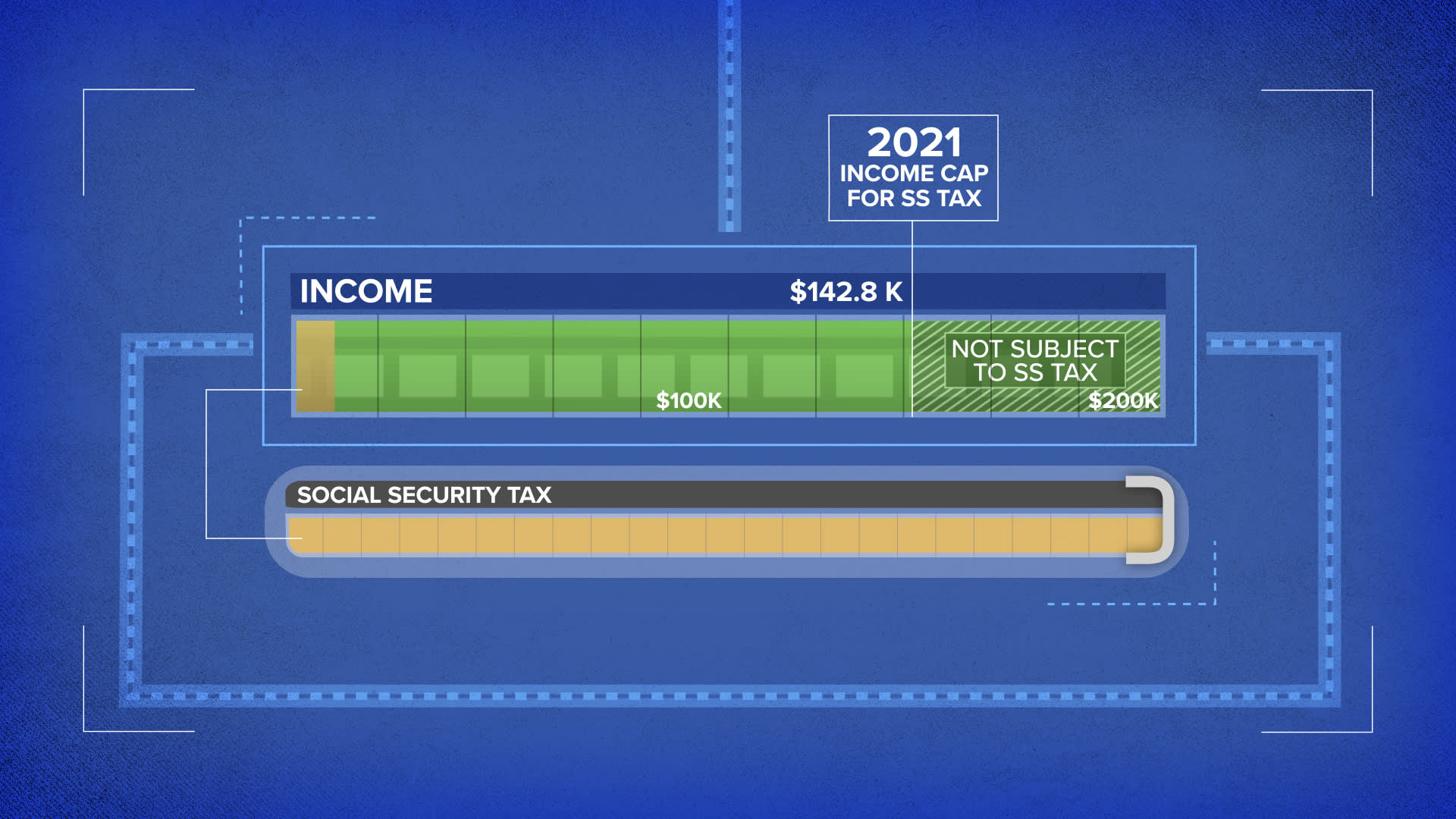

Social Security Tax Cap 2021 Here S How Much You Will Pay

Therefore the maximum amount that can be withheld from an employees paycheck in 2022 is.

. The 62 OASDI tax which funds various Social Security programs applies only to the first 147000 of a workers earnings for 2022. Each year the federal government sets a limit on the amount of earnings subject to Social Security tax. Theres only one way to get more.

The maximum Social Security benefit. 9 rows Maximum Taxable Earnings En español If you are working there is a limit on the. For 2022 the Social Security earnings limit is 19560.

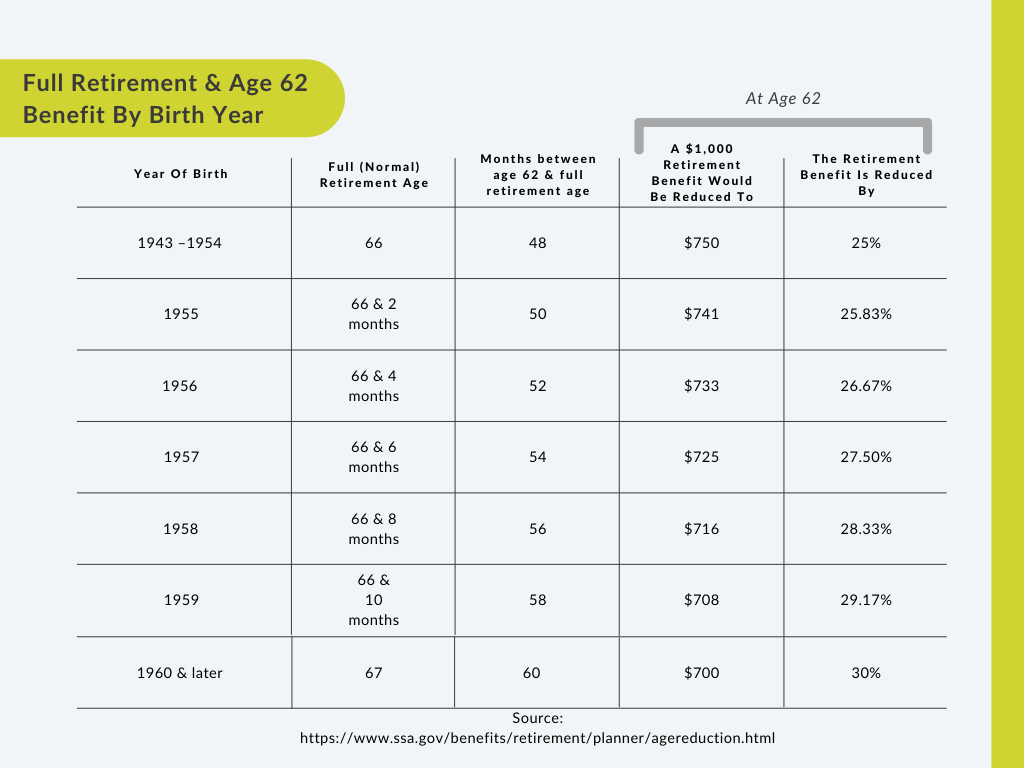

The OASDI tax rate for wages paid in 2022 is set by statute at 62 percent for employees and employers each. How to Calculate Your Social Security. Widow or widower with a disability ages 50 through 59.

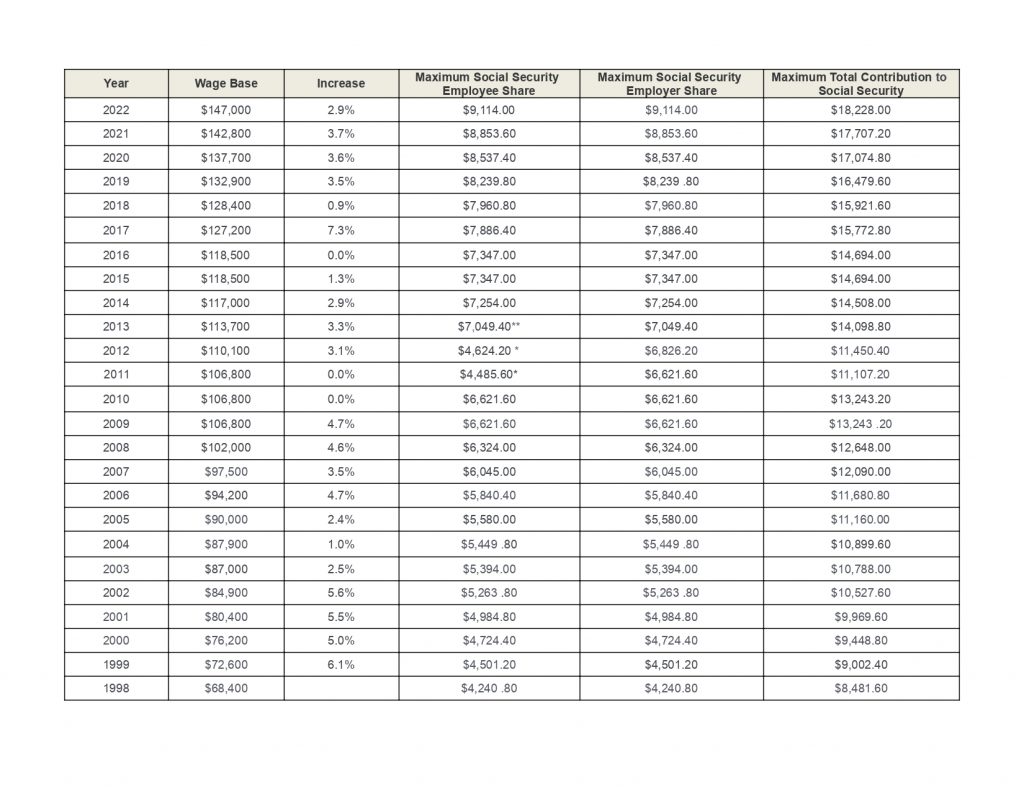

Social Security benefits will be reduced by 1 for every 2 earned over that limit. It was 137700 in 2020 and. Unlike many other tax cap limits this stands as an individual limit.

For 2022 the maximum limit on earnings for withholding of Social Security old-age survivors and disability insurance tax is 14700000. But this number is also tied to changes in. For 2022 that limit is 19560.

2 days agoIf your earned income is 160200 or greater in 2023 the maximum Social Security tax is 993240. In the year you reach full retirement age Social Security will deduct 1 in benefits for every 3 you earn above a different limit. 715 to 99 of the deceased workers benefit amount.

Widow or widower age 60 to full retirement age. Thus an individual with wages equal. However if youre married and file separately youll likely have to pay taxes on your Social Security income.

However the exact amount changes each year and has increased over time. For earnings in 2022 this base is 147000. As mentioned above in 2022 the maximum Social Security benefit is 3345 per month if you started receiving benefits at full retirement age.

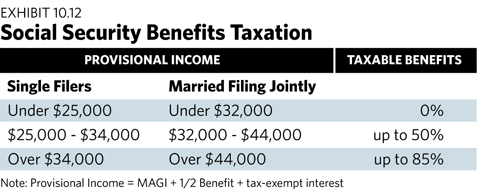

Fifty percent of a taxpayers benefits may be taxable if they are. For earnings in 2022. The 765 tax rate is the combined rate for Social Security and Medicare.

The Social Security Wage Base means that youll only ever pay Social Security taxes on 147700 and nothing else. If a couple is married each person would have a 147000 limit. The Social Security portion OASDI is 620 on earnings up to the applicable taxable maximum amount see.

Wage Base Limits Only the social security tax has a wage base limit. If that total is more than 32000 then part of their Social Security may be taxable. The combination of the increase in the Social Security tax limit and the additional Medicare tax for high-earners could result in lower take-home pay.

For comparison the contribution and benefit base in 2022 was 147000. The maximum wage taxable by Social Security is 147000 in 2022. You cant pay more than 18228 in taxes for Social.

The 2022 limit for joint filers is 32000. According to the SSA a worker with wages equal to or larger than 147000 would contribute 911400 to the OASDI program in. The Social Security tax limit is 147000 for 2022 up from 142800 in 2021.

The wage base limit is the maximum wage thats subject to the tax for that year. For instance up to 147000 of income is subject to Social Security payroll tax in 2022 but that figure will rise 9 to 160200 in 2023. The Social Security tax rate remains at 62.

Filing single head of. For self-employed workers the rate is 124. The exception to this dollar limit is in the calendar year that you will.

In 2022 the Social Security tax limit is 147000 up. This is up from 19560year 1630 per month in 2022. The 124 Social Security tax on.

Social Security And Medicare Tax Rates 2022 Way To Hunt

Social Security Boost 2022 What Is Changing In January Marca

Maximum Taxable Income Amount For Social Security Tax Fica

Publication 915 2021 Social Security And Equivalent Railroad Retirement Benefits Internal Revenue Service

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Avoiding The Social Security Tax Torpedo

Social Security Wage Base 2021 And Updated For 2022 Uzio Inc

The Evolution Of Social Security S Taxable Maximum

Income Limit For Maximum Social Security Tax 2022 Financial Samurai

2022 Social Security Taxable Wage Base And Limit

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Federal Insurance Contributions Act Wikipedia

Social Security Tax Limit Wage Base For 2022 Smartasset

:max_bytes(150000):strip_icc()/GettyImages-157422696-91d9faa2445f43fd95062873356b57bc.jpg)

2023 Social Security Tax Limit

Social Security Wage Cap Increase In 2022 Gusto

Social Security Benefits Increase 2022 Changes Meetcaregivers

What Is Fica Tax Contribution Rates Examples

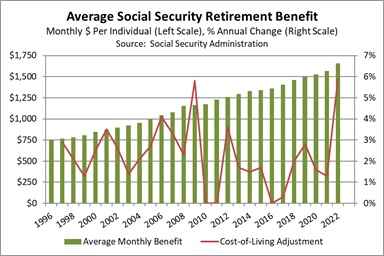

Asset Allocation Weekly The Inflation Adjustment For Social Security Benefits In 2022 October 22 2021 Confluence Investment Management